Did you know, employers can be fined and/or imprisoned for not submitting Borang E? In 2014, 65,392 employers were fined and/or imprisoned for not submitting it, as revealed in the Year of Assessment 2014.

So how do you avoid getting this fine/imprisonment? What is a Borang E? All will be explained down in this article.

As a business in Malaysia, you’ll want to avoid a fine of RM 200 – RM 20,000 and/or a maximum of 6-month imprisonment term under the Income Tax Act Section 120(1)(b). Furthermore, you’ll want to ensure that you file the form online. That’s because Lembaga Hasil Dalam Negeri (LHDN) / Inland Revenue Board of Malaysia (IRB) mandated this practice for the Year of Assessment (YA) 2018 and onwards.

Figuring out how to file Borang E can be an overwhelming annual process that requires a lot of re-learning each year. That is why it is extremely important to understand the ABCs of Borang E.

1. What is Borang E? And who must I file it for?

It is a declaration report and it is submitted by every employer to LHDN every year; it serves to report:

- Total number of employees within the company;

- Number of new hires;

- Employer’s details;

- Each employee’s details;

- A list of each employee’s income details;

- Those with annual gross remuneration of RM 34,000 and above.

- Those with monthly gross remuneration of RM 2,800 and above (including bonuses, except previous years’ salary arrears).

What if some of my employees’ income is less than the stipulated? In that case, you should indicate a “0” in part A of the employee data section.

Contracted employees or part-timers: do I need to report in Borang E as well? Yes. From interns to contracted employees, part-timers to full-timers; all individuals employed in any kind of arrangement under your company must have their details reported in the form accordingly.

What about employees who have quit work and left Malaysia?

- If you’re the employer, you will need to give notice of said employee leaving Malaysia 3 months or more. This notice has to be given to the LHDN branch where the employee’s income tax file is located; this is so the Certificate Tax Settlement can be issued.

- You will also need to withhold the employee’s salary due to tax settlement purposes. This notice must be done within one month before the day the employee leaves Malaysia. However, you do not have to give out notice if the employee is on a regular basis of travel.

2. When is the deadline and who should submit the form?

As of 2022, the deadline for filing Borang E in Malaysia is:

- March 31 for manual submission

- April 30 for electronic filing i.e. Form e-E

All companies must file Borang E regardless of whether they have employees or not. Any dormant or non-performing company must also file LHDN E-Filing. All partnerships and sole proprietorships must now file this form as well.

| Type of Company | Staff | No Staff | Report Borang E |

| Berhad | Yes | Yes | Yes |

| Sdn Bhd | Yes | Yes | Yes |

| Sole-Proprietor A | Yes | – | Yes |

| Sole-Proprietor B | – | Yes | Yes |

| Partnership A | Yes | – | Yes |

| Partnership B | – | Yes | Yes |

| Individual | – | – | Not Required |

LHDN no longer accept manual submissions from companies. However, why is there a deadline for manual submission? That is because employers who are not companies have the option to submit Form E either via e-Filing or paper form.

What if a company proceeds with a paper/manual submission of the tax form? In that case, LHDN has the right to not accept the submission under subsection 83(1B) of the Income Tax Act 1967 (ACP 1967).

3. How do I submit Borang E?

Firstly, an employer must register the Employer (“E”) file first. Furthermore, because LHDN no longer accepts manual forms, all PCB calculations have to be done online. Hence, it’ll be good for a company to use an online payroll system that is PCB-compliant and Borang E-ready.

To check whether a payroll software is legitimately PCB-compliant and Borang E-ready, see that it is approved and certified by LHDN. After all, this is the safest way to ascertain that the payroll software you want to use is safely compliant with employment requirements in Malaysia for tax filing purposes like Borang E.

4. What are the specific details to look out for in Borang E?

Basic Information

In this section, the following are required:

- Name of Employer. This name should be as registered with the Companies Commission of Malaysia (SSM) or others.

- If there is any change to the employer’s name, simply indicate the former name in parenthesis.

- What if the employer is not registered with SSM or others? In that case, simply fill in the name as per identity card or passport.

- Employer’s Number. An employer’s file number is required. E.g. E12345678.

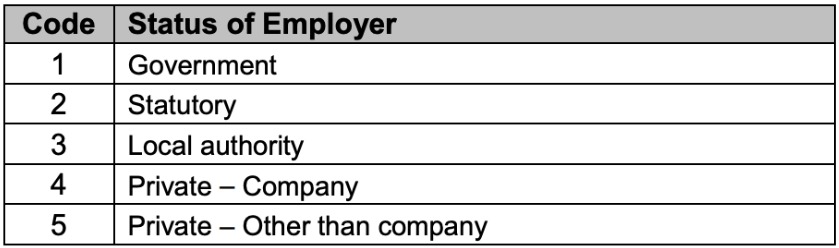

- Status of Employer. With reference to the table below, you should indicate the Status Code as ‘4’ if the employer fronts a private company.

- Status of Business. If a company has never commenced operations since the date it was incorporated or established, the status of business is considered ‘Dormant’. A business is also considered ‘Dormat’ if it had previously been in operation or business but has now ceased these activities.

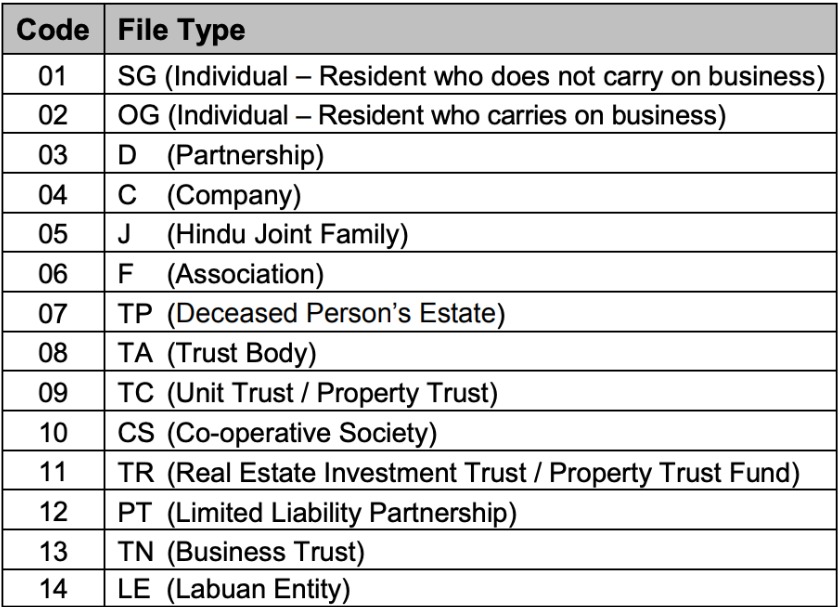

- Income Tax Number. The first two numbers would be the File Type Code, while the subsequent string of 11 numbers are the Income tax Number. You can ascertain each employee’s File Type Code by referring to the table below.

- Identification Number and Passport Number. These details have to be indicated by the precedent partner or sole proprietor of the business, if any.

- Registration Number with SSM or Others. This is the number as registered with the Companies Commission of Malaysia (SSM) or others.

- Correspondence Address, Telephone Number, Handphone Number and Email. These contact details will be used for any correspondence with LHDN, so do ensure that they are correct.

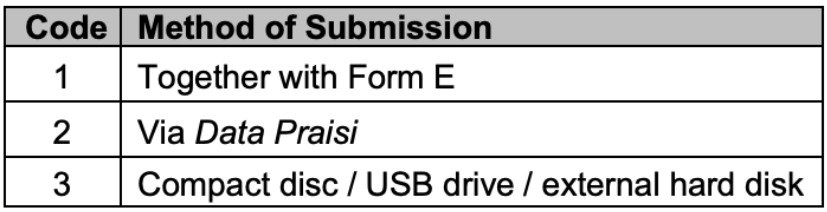

- Return of C.P.8D. This is where you enter the relevant code for the method of submission in the box provided.

Information on the Number of Employees for YA 2020

| Total number of employees as of 31/12/2021 | The total number of employees in the employer’s company /business as at 31 December 2021 including full-time/part-time/contract employees and interns. |

| Number of employees subject to MTD/PCB | The total number of employees subject to the Monthly Tax Deduction (MTD) scheme during the year 2021. |

| Total number of new employees | The total number of employees who commenced employment in the employer’s company/business during the year 2021. |

| Number of employees who ceased employment | The total number of employees who ceased employment in the year 2021. |

| Total number of employees who ceased employment and left Malaysia | The total number of employees who ceased employment to leave Malaysia (‘foreign leaver’) in the year 2021. |

| Reported to LHDN (if A5 is applicable) | This item has to be completed if item A5 is applicable. Enter ‘1’ (‘Yes’) if the employer has reported the cessation to LHDN. If ‘2’ (‘No’) is entered, immediately contact the LHDN branch in charge of the employee’s income tax file. |

Return of Remuneration from Employment, Claim for Deduction and Particulars of Tax Deduction for YA 2020

| A | Number in Order | The numbering should be in ascending order here. In other words, the first Borang E filled in for an employee should be indicated as “1”. Then, each subsequent Borang E filed for the rest of the employees should be numbered as “2”, “3”, etc. |

| B | Name Of Employee | Enter the full name of the employee as per his or her identity card/passport. |

| C | Income Tax No. | Key in the employee’s income tax number in this item. Example: SG 10234567080 |

| D | Identification / Passport No. | Enter the employee’s Identification (Identity Card / Police / Army) or Passport No. in the box provided. Tip: Try to give priority to New Identity Card No. followed by Police No., Army No. and Passport No. |

| E | Category Of Employee | Indicate the following single-digit code for the relevant employees. 1 = Single Employees 2 = Married and spouse is not employed 3 = Married and spouse is working, divorced or widowed, or single with an adopted child. |

| F | Tax Borne by Employer | Enter ‘1’ (‘Yes’) if the employee receives benefit from tax borne by his employer (tax allowance). Alternatively, you can indicate ‘2’ (‘No’) if the employee does not receive this benefit in the year 2020. |

Qualifying Child Relief

| G | No. Of Children | State the number of children on whom the employee is eligible to claim tax relief for the year 2021. |

| H | Total Relief | State the total child relief taken into account in computing the employee’s last MTD for the Year of Remuneration 2021. |

| I | Total Gross Remuneration | The total gross remuneration of employee chargeable to tax, including: ∼ Benefits in kind ∼ Value of living accommodation benefit ∼ Overdue gross remuneration from preceding years that were received in 2021. |

| J | Benefits In Kind | Value of benefits in kind received by the employee from the employer. |

| K | Value Of Living Accommodation | Value of living accommodation benefit received by the employee from the employer. |

| L | Employee Share Option Scheme (ESOS) Benefit | Value of benefit from shares received by the employee from the employer. |

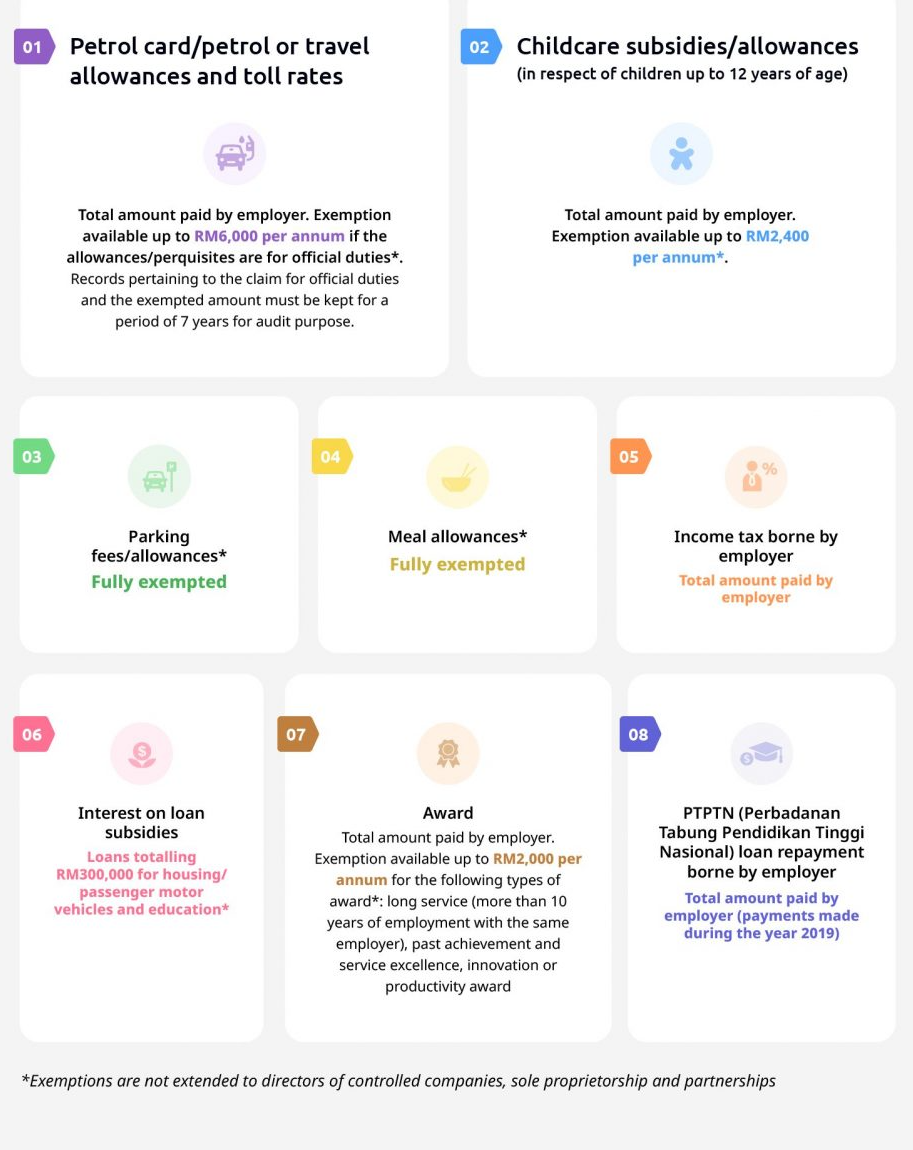

M. List of Tax-Exempt Allowances/ Perquisites/Gifts/Benefits

Total Claim for Employee via Form TP1

| N | Relief | Total deduction claimed by the employee for the year 2020. This is the total amount from Part C (Particulars Of Deduction) of Form TP1* (if any) submitted by the employee and processed by his employer. |

| O | Zakat | The total amount claimed by the employee in 2020 on zakat. This excludes payment via monthly salary deduction i.e. the total of amounts from Part D (Rebate) of Forms TP1 (if any) submitted by the employee and processed by his employer. |

| P | Contribution To EPF | Total compulsory contribution paid by the employee to the Employees Provident Fund (EPF). |

| Q | Zakat Paid Via Salary Deduction | The total amount of zakat paid by the employee via salary deduction. |

Total Tax Deduction

| R | MTD | The total amount of income tax deducted under the Income Tax Rules (Deduction from Remuneration) 1994, and remitted to LHDN in respect of the employee. The MTD/PCB made for the year 2021 in respect of the employee shall include: – Income for 2021; – Employment income for preceding years paid in the year 2020 (including bonus, director’s fee, arrears of salary and any other remuneration); and – Employment income received in advance for the relevant year which is paid in 2021. |

| S | CP38 | The total amount of income tax deducted as per Form CP 38 instruction, and paid to LHDN in respect of the employee |

Paying taxes aren’t the only trouble that employers have to go through, there’s also a matter of handling employees. So why make it hard on yourself, looking to:

vStaff is a cloud-based HR software that encourages Employee Self-Service (ESS), that way employees can handle their own matters without needing to contact HR. It helps speed up the work flow and saves time meeting face to face for things like leave.

But that’s not all vStaff is capable off; for more information or HR advice, you can contact us at [email protected] or send us a WhatsApp message via the green icon in the corner.

Source: Talenox.com