First and foremost, we take this opportunity to wish you all Happy New Year and may the year 2023, the year of the water rabbit bring us all great success and abundance despite the projected economic slowdown.

Nevertheless, we wish to take this opportunity to inform you that the Employment Act Amendment 2022

shall take effect January 1, 2023 as per the latest news update by the new HR Minister Mr V. Sivakumar

as announced on Wednesday, December 21, 2022.

The key changes shall be as follows in line with our earlier update broadcasted via WhatsApp on 26th

August 2022:

EA 1955 Shall Now Cover ALL Employees

Up till now, the employment act 1955 only covered employees who received monthly salaries of

RM 2,000 and below (as well as other specified categories of workers). With the amendment to

the First Schedule (Amendment of First Schedule) Order 2022, the EA now cover all employees

irrespective of wages.

However, the caveat here is that those earning above RM 4,000 per month are exempted from

certain provisions i.e., overtime payment for normal, rest day and public holidays, shift allowance,

termination and lay-off benefits.

Basically, now even employees whose salary level is RM 4,000 and above have the right to file a

complaint or take any salary disputes to the labour department (JTK).

Employees Are Now Entitled to Request Flexible Working Arrangement (FWA)

The amendment includes a new part called – Part XIIC, that provides for flexible working

arrangements. In the last 2 years, during the MCO and post MCO period a lot of organization have

adopted some form of FWA and other modern work models to ensure business continuity.

Under Section 60P and 60Q, employees now have the right to request for flexible work

arrangement from employers and employers must respond with a decision within 60 days.

Employers are required to provide valid reasons and are required by law to review any employee’s

application for FWA and must provide valid reasons or grounds for such refusal.

Please take note that whilst the Amendment Act comes into force in January 2023, it is not

mandatory for employers to establish and implement a Flexible Working Arrangement Policy.

However, we, highly recommend that Companies consider introducing a FWA policy to provide

clarity for both the management and employees regarding the company’s position pertaining to

flexible working arrangements.

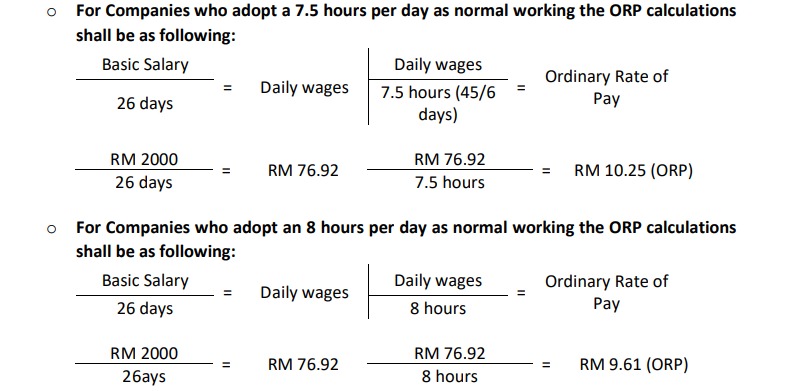

Change in Maximum Weekly Working Hours

The Amendment Act 2022 reduces the maximum working hours per week from 48 hours to 45

hours, for all employees under the scope of EA 1955 irrespective of whether they are non-shift

employees or shift employees.

The reduction in working hours from 48 hours to 45 hours, is one of the most significant change

which would affect companies in Malaysia especially those who operate round-the-clock i.e., the

manufacturing and services sectors such as hotels and resorts that run their business on a

continuous basis. For employers whose operations are round-the-clock on a continuous basis on

shift work have the following option:

- Option 1: 7.5 hours per day on 6 working days week with a total of 45 hours a week

- Option 2: 8 hours per day on 6 working days week but cannot exceed 45 hours a week

The law allows for employers and employees to have mutual agreement on working hours as long

as an average number of hours worked over any period of three weeks, or over any period

exceeding three weeks shall not exceed 45 hours per week

Take note, the Employment (Amendment) Act 2022, only covers reduction in total weekly hours

from 48 hour to 45 hours, the maximum 104 hours for overtime shall still remain.

The ORP Calculations shall be as following:

Increased Paid Maternity Leave for Working Mothers

The previous paid maternity leave of 60 calendar days shall be increased to 98 calendar days up

to 5 surviving children.

In addition, the amendment also includes more protection for pregnant female employees where

it will be offence under the Employment Act to terminate or serve notice during the pregnancy

with the exception:

- a) Termination due to breach of contract.

- b) Termination due to misconduct.

- c) Termination due to closure of business.

The Introduction of Paid Paternity Leave

The new addition is a landmark for employment law in Malaysia as working fathers shall be

entitled to 7 calendar days of paid paternity leave (consecutive) under Subsection 60FA.

However, some conditions apply:

- The male employee must be married to the mother in question.

- He must be employed by the same employer for at least 12 months.

- He must notify the employer at least 30 days from the expected confinement (or as early as possible)

Protection for Gig Workers (Presumption as to Who Is an Employee and Employer)

Under section 101C (1) failure to issue a written contract of service by the employer within 30

days from the date of employment, shall be an offence under the Act. As per the amendment to

the First Schedule, this applies to all categories of employees.

It is not uncommon for companies to engage short term employees on service agreement ranging

from 3 to 6 months. Some are hired on a daily basis without an employment contract. Should

any disputes arise with regards to an individual’s status i.e. “service provider” or employee the

litmus test is what is the level of control does the “Company” have over the individual, in term of

working hours, work location, tools including salary.

Section 101C stipulates: that a worker will be considered as an “employee” if the manner and the

hours of work are subject to the control or direction of another person, if his hours of work is

controlled, if provided with tools, materials or equipment, if work constitutes an integral part of

the business, if solely for the benefit of other party and if majority of his income is derived from

the other party.

Another point to note, is part-time employees, any worker whose average hours of work per week

is more than 30% but do not exceed 70% of the normal working hours per week (45 hours) shall

be deemed as a part -time employee under Employment (Part-time Employees) Regulations 2010.

Hence, the employee shall be eligible for part timers employment benefits under the Regulations

2010.

Sexual Harassment Awareness

A new section has been added to raise awareness on sexual harassment under Section 81H,

whereby employers are required to display a notice to raise awareness on sexual harassment the

workplace. This notice must be place in a conspicuous location and must be displayed at all times.

It will be advisable for the employer to also develop a sexual harassment policy and communicate

this to all employees either via a memo or in the Company’s employee handbook.

Employment of Foreign Workers

Changes also been affected to Section 60K which covers the employment of foreign workers.

Previously, the section requires employers to inform the Director General of the employment of

new foreign workers within 14 days of employment.

Now, employers are required to obtain prior approval from Director General in order to hire

foreign workers. In addition, employers must also notify the Director General within 30 days if

and when a foreign worker is terminated.

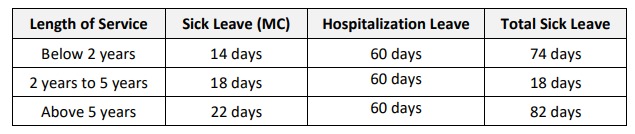

Increase of Hospitalisation Leave

With the amendment to section 60 F, the aggregate 60 days of sick and hospitalisation leave is

revised segregating both sick leave and hospitalisation leave. This means the outpatient sick leave

is not part of the 60 days hospitalisation leave anymore. One of the proviso or condition for

hospitalization leave which mentions that an employee shall be entitled to 60 days in aggregate

as sick leave i.e., outpatient MC plus hospitalization has been deleted.

By the removal of this condition, employees sick leave entitlement shall be as following:

The above changes take into effect from January 1, 2023, you may issue a memo to inform you all the

employees of the latest update and inform the employees that the Company shall comply to the following

changes. Alternatively, or in addition to the memo issued, you may update your employee handbook and

distribute the amended and latest handbook to each employee.

Whilst it is crucial for Companies to adhere to theses amendments, we should not overlook the impact of

these changes on the business. The world is already heading towards a global recession, where IMF has

warned in October that more than a third of the world economy will contract and there is a 25% chance

of global GDP growing by less than 2% in 2023, which it defines as a global recession.

We can already see the various forecasts show that the global economic outlook for 2023 is not as positive

as 2022. In Malaysia, the weakening ringgit has increased the cost of doing business shall be continuously

rising. Businesses needs to focus on cost reduction before it’s too late. The right cost reduction strategies

can help the organizations business sustainability and to maintain competitiveness in 2023.

Companies need to put more emphasis on improving organizational capabilities to drive efficiency, and

productivity. Organizations big and small, need to pay more emphasis on manpower optimization and

enhancing productivity. The workforce needs to be upskilled and reskilled to keep up the technological

advancements to enhance the organization’s capability to continuously remain competitive. It is more

important now for businesses, especially SME’s to start embracing automation, digitalization and

outsourcing of business processes as part of the cost reduction solutions.

We wish you all a great 2023 and let’s strive together for our own greatness. Trust the legislation changes

will definitely have an impact to businesses and let’s tackle any issues or challenges as it comes and our

team in I-HR is committed to assisting you always.

Please feel free to connect with us (HR Advisory Head) – Encik Muhammad Danial for further clarification

or information or any assistance.

Disclaimer:

The update is based on information provided by JTK, some of our discussions with them, our research and

best practices of SMEs. Please do consult us or your legal, team prior to adopting any procedure or making

changes for any specific circumstances or situation affecting your business.

For any further enquiries, please contact us at (603) 2287 3500 or email your enquiries to our following

Consultants

• En. Muhd Danial Roy : [email protected]

• Ms Stephanie Choo : [email protected]

• Ms Jackie Cheah : [email protected]